Executive summary

The digital transformation genie emerged from its bottle during the COVID years and is unlikely to ever go back. Executives were forced by sheer necessity to embrace new ways of working built around digital technologies and these have opened many executives’ minds to the potential of a truly digital way of scaling their businesses.

They have, for example:

- watched customers embrace the convenience of digital delivery

- seen order fulfilment times accelerate

- witnessed the operational efficiencies that can be generated

- accessed new, rich troves of data on which decisions can be made.

ADAPT’s research with Australian enterprise and government organisations reveals significant progress. 47% of all transactions are now captured and – to a lesser extent, fulfilled – via digital means. 1 Becoming a digital business is no longer optional for success: organisations that don’t embrace this will rapidly become irrelevant.

However, the accelerations in digital commerce and government have placed pressure on local legislators to ensure that their oversight is fit for purpose. The reality is that in many areas, such as cyber security, data governance and identity management, the deficiencies of the new digital economy are becoming increasingly apparent. Inevitably, executives must acknowledge that regulators, focused on ensuring that consumer interests are safeguarded, are playing catch-up in developing the compliance requirements that will protect people. The more these vulnerabilities are understood, the deeper that these regulatory obligations will become. The management tasks for executives are likely to only get harder.

Therefore, the decision organisations must confront is whether they should:

- address each new regulatory obligation as an individual, one-off, requirement as or when it emerges, or

- establish a mechanism that gives them the capability to ensure meeting every emerging legislative requirement becomes relatively straightforward.

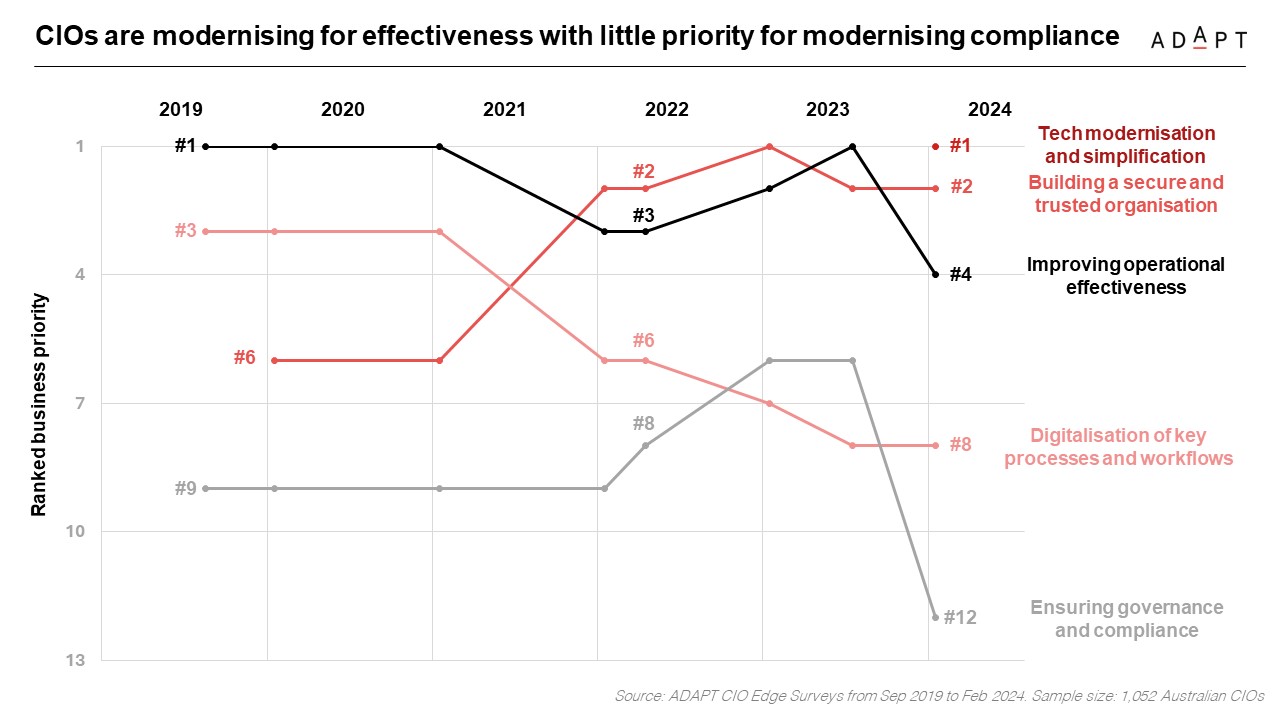

As recent Royal Commissions in Australia have clearly demonstrated, fulfilling the compliance and regulatory obligations placed on their organisations is not optional. Even in tight economic times, with constrained budgets, ensuring their organisations comply with the rules must be executives’ top priority. The alternative is highly likely to be the ignominy of fronting a Senate inquiry with all the associated business reputational damage that their companies would incur. Yet the prioritisation that CIOs give to this remains low – it’s their number 12 priority in 2024.

This report argues that recognising these circumstances, Australian executives must build a business platform that gives their company the capability to address any current and emerging compliance obligations. After exploring the market context in more detail, we set out 5 recommendations to build a mechanism that can simplify compliance.