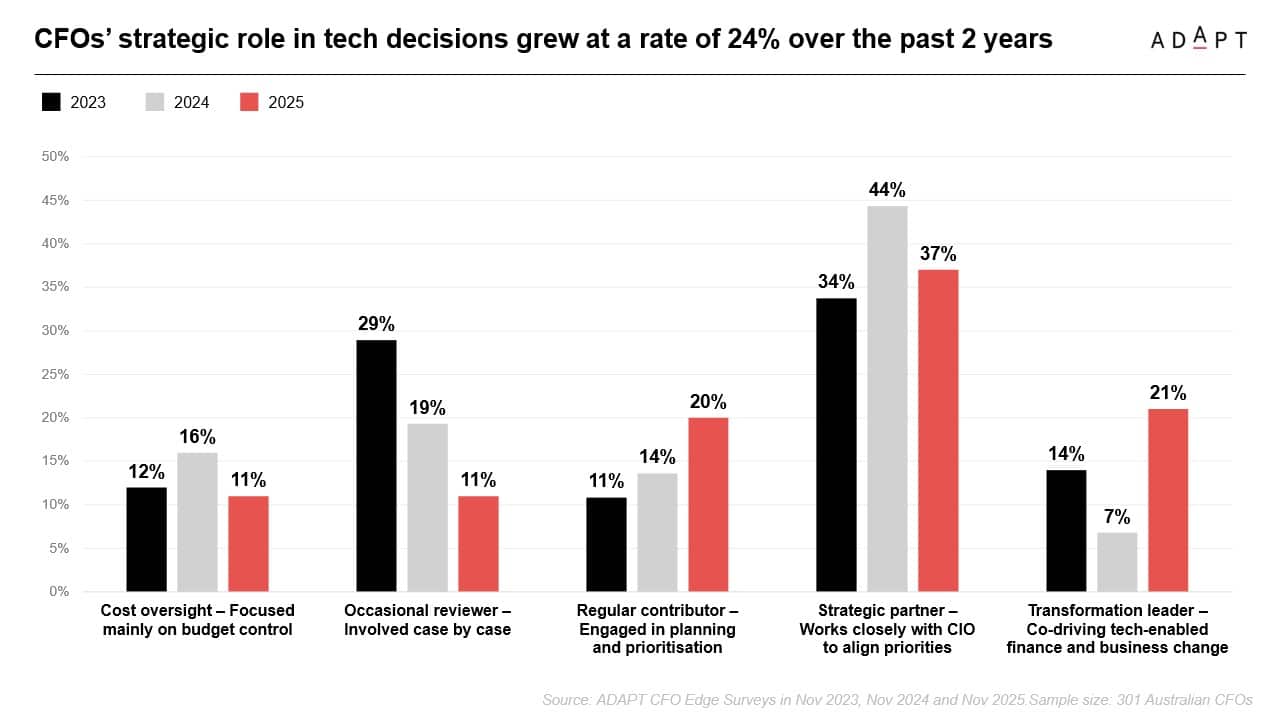

CFOs are becoming powerful co‑owners of enterprise technology strategy, shifting from financial oversight to direct influence on technology selection, governance and outcomes. Their evaluation lens is increasingly dominated by value, risk and measurable performance. With growing pressure to show returns within 6–12 months, CFOs perceive long payback periods and low adoption rates as signs of waste and weak execution. Priorities for FY25–26 emphasise a disciplined, value-first transformation agenda: balancing growth and productivity ambitions with cost optimisation, simplification, and tighter IT–business alignment. Skills shortages, legacy complexity and competing priorities continue to slow execution, reinforcing the CFO’s push for accountability and delivery discipline.

Core insights:

- CFOs now co‑lead technology decisions: Their influence has shifted from approving budgets to owning value outcomes, with financial, risk and productivity metrics at the centre of technology evaluation.

- Value realisation must be fast and measurable: CFOs expect payback within 6–12 months and increasingly view under‑adoption,…